Spending less than you earn can also help you ratchet up your emergency fund-a pool of money, equal to three to six months’ worth of essential expenses, that sits in a savings account in case some unforeseen cost arises. After all, money is fungible: What difference does it make if you spend, say, $500 on groceries and $500 on dining out, as long as you arrive at the end of the month having shelled out less than you earned? Still, some may find categorizing expenses a helpful guardrail to stay on track and increase their savings. It is a little strange, though, when you take a step back. You divide your spending into different buckets and draw down on those buckets for the month until you get to zero. This is the hallmark of both Mvelopes and YNAB.

Keeping tabs on what you actually spend will help you not only stay within the current month’s budget but also adjust your assumptions for next month’s. This was the service Mint so uniquely supplied when it launched back in 2006. As Olen points out, this can be tricky for some, but less so if you earn an income via a regular W-2. You need to have a guess as to how much you’ll earn to know how much you can spend. (Useful if one or all your securities at one brokerage move to another company.) But you can't just move individual transactions - for that, you must use Add/Remove shares or Transfer Shares, as said.

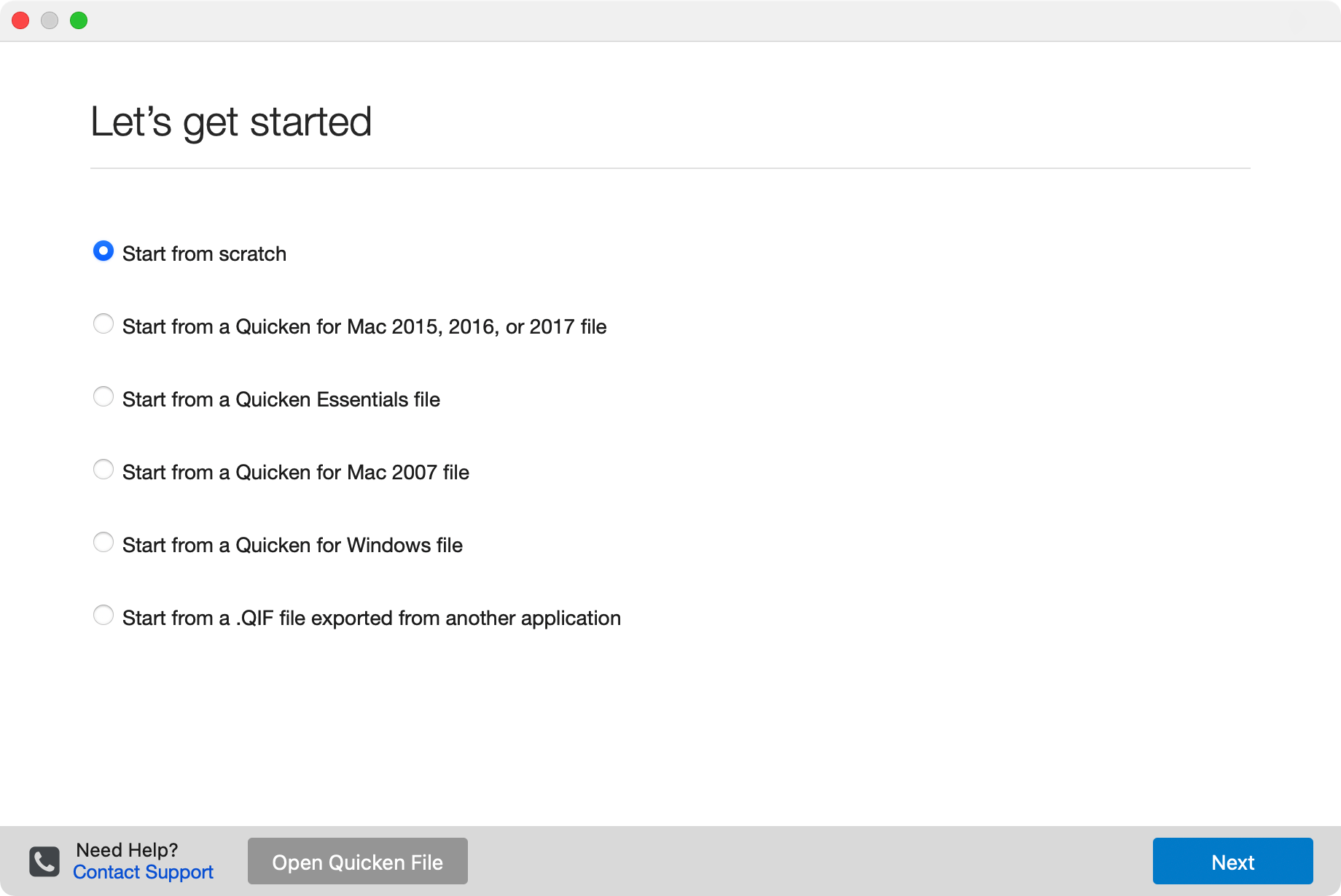

I put my transaction in the wrong account quicken for mac mac#

One of the new features in Quicken Mac this year allows users to transfer one security, or all securities, from one investment account to another. You could cause a host of problems in your holdings and all your investment performance calculations if you were able to simply move any transaction from one investment account to another the same way - so the program doesn't' allow it.Īnd yes, now that I'm on the same page with understanding what you were trying to do, I think your original conclusion was correct: for an investment transaction, Quicken shouldn't even show the dropdown menu of accounts to suggest you could make a change there. It can also be done the way you describe: if you choose a multi-account main or sub-group to view, and you have the Account column showing, you can edit a transaction, change the Account, and it will move to the destination account.īut as explained above, this works for Banking transactions, not for Investment transactions. In Quicken Mac, the normal way to move a transaction inadvertently made in the wrong account is to click on it in the register and drag the transaction to the desired account in the left sidebar - and the transaction moves from the original to the destination account.

When you click on one of the main groups (such as Investing or Banking) or sub-groups (such as Cash, Credit Card, Brokerage, or Retirement), Quicken adds an Account column so you can see which account each transaction belongs to in this register of multiple accounts.

Just to clarify, in an individual account, there is no column showing the Account. The "Banking" accounts are different from the "Investment" accounts. When you click on one of the categories on the left hand menu (All Transactions Banking Credit Cards Investing Property/Debt Debt etc.) and chose to display "Transactions" rather than "Income", "Portfolio", or another option, the last column displayed on my set up is the Quicken account that the transaction occurred in.

0 kommentar(er)

0 kommentar(er)